1099 r box 14 state distribution blank Find TurboTax help articles, Community discussions with other TurboTax users, . F100 vs. F250 frame steel thickness. General Discussion Topic Archives. Post Reply. 18 posts Previous; 1; 2; Jake11 Blue Oval Fanatic Posts: 826 Joined: Mon Nov 21, 2005 1:31 am. re: F100 vs. F250 frame steel thickness. Quote; Post by Jake11 » Mon Feb 27, 2006 1:51 am. Thank's, then I'm gonna keep my 250 frame afterall. I always liked it.

0 · is a 1099 r taxable

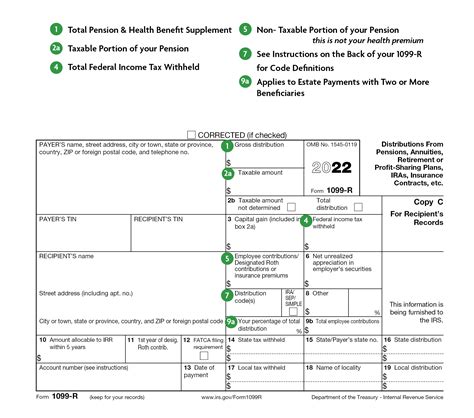

1 · irs 1099 r distribution codes

2 · irs 1099 r 2023

3 · internal revenue service 1099 r

4 · gross distribution on 1099 r

5 · 1099 r form pdf

6 · 1099 r boxes explained

7 · 1099 r box 16 blank

$152.70

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution.

electrical gang box non metalic cover24 in 1configurations

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT .TurboTax is here to make the tax filing process as easy as possible. We're .Find TurboTax help articles, Community discussions with other TurboTax users, .

We would like to show you a description here but the site won’t allow us. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15, and 16 are blank. See this article for more information on . When there in only one state listed in box 13, then it is understood that the state distribution is the *same* as the federal distribution, so financial institutions just leave box 14 .

For a distribution of excess contributions without earnings after the due date of the individual's return under section 408(d)(5), leave box 2a blank, and check the “Taxable amount not .

Also NY state tax withheld $'s in box 14, but state tax distribution in box 16 blank. Proseries will not allow state witholding in 14 unless 16 is filled in. Read on some boards that if .

In Jan'24, we received 1099-R for Traditional and Roth IRA, and noticed that the address is still California, Box 15 says CA with the payer's state number. Box 14 is blank (no state tax .

Boxes 14 – 19 show state and local tax withholdings as well as the part of the distribution reported to the state.Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding. On my 1099-R the bank shows state distribution on line 16, which is not correct because I live outside of US since several years which they always knew. For example I had .

In both the online and download versions TurboTax shows Box 12 as "FATCA filing requirement box is checked" and Box 14 as "State Tax Withheld." If you are using the .There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution.

If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15, and 16 are blank. See this article for more information on Form 1099-R. When there in only one state listed in box 13, then it is understood that the state distribution is the *same* as the federal distribution, so financial institutions just leave box 14 blank because a blank box 14 means the same at the box 1 amount.For a distribution from a Roth IRA, report the total distribution in box 1 and leave box 2a blank except in the case of an IRA revocation or account closure and a recharacterization, earlier. Use Code J, Q, or T as appropriate in box 7. Also NY state tax withheld $'s in box 14, but state tax distribution in box 16 blank. Proseries will not allow state witholding in 14 unless 16 is filled in. Read on some boards that if resident in state whole year just add 2.a taxable to box 16 state distribution.

In Jan'24, we received 1099-R for Traditional and Roth IRA, and noticed that the address is still California, Box 15 says CA with the payer's state number. Box 14 is blank (no state tax withheld), Box 16 is also blank.

Boxes 14 – 19 show state and local tax withholdings as well as the part of the distribution reported to the state.

is a 1099 r taxable

On my 1099-R the bank shows state distribution on line 16, which is not correct because I live outside of US since several years which they always knew. For example I had also withdrawn in 2021 and that field (line 16) was (correctly) empty in my 1099-R as I was living outside of US in 2021 too. Taxpayers who take retirement distributions may receive IRS Form 1099-R in the January following the calendar year of their distribution. However, this tax form serves many purposes besides simply reporting retirement benefits. In this article, we’ll walk through IRS Form 1099-R, including: In both the online and download versions TurboTax shows Box 12 as "FATCA filing requirement box is checked" and Box 14 as "State Tax Withheld." If you are using the TurboTax download version, please make sure your program is up-to-date. To get updates please follow these steps: Click the Online button in the black toolbar at the top of your screen.

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15, and 16 are blank. See this article for more information on Form 1099-R. When there in only one state listed in box 13, then it is understood that the state distribution is the *same* as the federal distribution, so financial institutions just leave box 14 blank because a blank box 14 means the same at the box 1 amount.For a distribution from a Roth IRA, report the total distribution in box 1 and leave box 2a blank except in the case of an IRA revocation or account closure and a recharacterization, earlier. Use Code J, Q, or T as appropriate in box 7.

Also NY state tax withheld $'s in box 14, but state tax distribution in box 16 blank. Proseries will not allow state witholding in 14 unless 16 is filled in. Read on some boards that if resident in state whole year just add 2.a taxable to box 16 state distribution.

In Jan'24, we received 1099-R for Traditional and Roth IRA, and noticed that the address is still California, Box 15 says CA with the payer's state number. Box 14 is blank (no state tax withheld), Box 16 is also blank. Boxes 14 – 19 show state and local tax withholdings as well as the part of the distribution reported to the state.

On my 1099-R the bank shows state distribution on line 16, which is not correct because I live outside of US since several years which they always knew. For example I had also withdrawn in 2021 and that field (line 16) was (correctly) empty in my 1099-R as I was living outside of US in 2021 too. Taxpayers who take retirement distributions may receive IRS Form 1099-R in the January following the calendar year of their distribution. However, this tax form serves many purposes besides simply reporting retirement benefits. In this article, we’ll walk through IRS Form 1099-R, including:

irs 1099 r distribution codes

Push the box with the large flathead screwdriver and bend the metal tabs. Pinch the tabs tightly with needle nose or with long nose pliers. A metal electrical outlet box is secured to the finished wall with two bent-over Madison Bars.

1099 r box 14 state distribution blank|1099 r form pdf