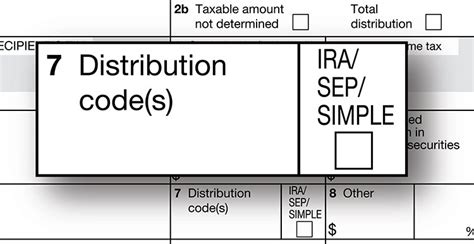

distribution code 1 is on form 1099-r box 7 For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions. STYLECNC is a guaranteed Cabinet CNC router machine manufacturer, supplier and seller. STYLECNC provides all-around CNC machining solutions with all kinds of best CNC machines for sale to fit your projects. STYLECNC offers cost price for your 2D/3D CNC machining plans without any intermediate.

0 · irs distribution code 7 meaning

1 · irs 1099 distribution codes

2 · irs 1099 box 7 codes

3 · distribution code 7 normal

4 · distribution code 7 non disability

5 · 7d distribution code 1099

6 · 1099 box 7 code m

7 · 1099 4 box 7 codes

Find many great new & used options and get the best deals for Beautiful Hinged Wood Gift Box with Red Metal Bow ~8×8×4” Birthday Decorative at the best online prices at eBay! Free .

However, use Code 1 even if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, or a qualified reservist distribution under section 72(t)(2)(B), (D), (E), (F), or (G).The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).

allsource 41200 front open dual station abrasive blast cabinet steel

For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; Investment .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified .

You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, . You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) .

However, use Code 1 even if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, or a qualified reservist distribution under section 72(t)(2)(B), (D), (E), (F), or (G).The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no . Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; Investment Advisor Support . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R. You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R.

However, use Code 1 even if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, or a qualified reservist distribution under section 72(t)(2)(B), (D), (E), (F), or (G).The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no . Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).

For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; Investment Advisor Support . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R.

irs distribution code 7 meaning

$18.99

distribution code 1 is on form 1099-r box 7|distribution code 7 normal