1099 box 7 distribution code 2 exceptions Because you separated from service at 55, you are not penalized for not being 59 1/2. This meets the following 10% penalty exception: Qualified retirement plan distributions you .

XGN15 series box-type fixed AC metal-enclosed switchgear is a compact and expandable metal-enclosed ring that uses FLN-12 SF6 load switch as the main switch and the whole cabinet adopts air-insulated, suitable for distribution automation. network switchgear.

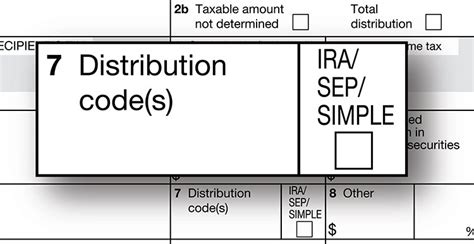

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099 r distribution code meanings

5 · 1099 r distribution code 7m

6 · 1099 form distribution code 7

7 · 1099 box 7 code 1

Contact us. WUKO Inc. 3505 Associate Drive Greensboro NC 27405. Toll free: .

Use Code 2 only if the participant has not reached age 59½ and you know the distribution is the following. - A Roth IRA conversion (an IRA converted to a Roth IRA). - A distribution made from a qualified retirement plan or IRA because of an IRS levy under section .

Use Code 2 only if the participant has not reached age 59½ and you know the .

About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; .

May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .We would like to show you a description here but the site won’t allow us. Because you separated from service at 55, you are not penalized for not being 59 1/2. This meets the following 10% penalty exception: Qualified retirement plan distributions you .We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except .

Distributions to terminally ill individuals. The exception to the 10% additional tax for early distributions is expanded to apply to distributions made to terminally ill individuals on or after . Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 2: Early . Use Code 2 only if the participant has not reached age 591/2 and you know the distribution is the following. A Roth IRA conversion (an IRA converted to a Roth IRA). A . You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) .

You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another . Use Code 2 only if the participant has not reached age 59½ and you know the distribution is the following. - A Roth IRA conversion (an IRA converted to a Roth IRA). - A distribution made from a qualified retirement plan or IRA because of . Because you separated from service at 55, you are not penalized for not being 59 1/2. This meets the following 10% penalty exception: Qualified retirement plan distributions you receive after separation from service when the separation from service occurs in or after the year you reach age 55 (age 50 for qualified public safety employees).

commercial stainless steel countertops cabinets

We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no known exception; 2 – Early distribution (except Roth), exception applies; 3 – Disability; 4 – Death; 5 – Prohibited transaction; 6 – Section .Distributions to terminally ill individuals. The exception to the 10% additional tax for early distributions is expanded to apply to distributions made to terminally ill individuals on or after December 30, 2022. For more information, see Notice 2024-02. Disaster tax relief.

Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4.

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 2: Early distribution, exception applies. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not .

common sheet metal thicknesses

Use Code 2 only if the participant has not reached age 591/2 and you know the distribution is the following. A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331. You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R.You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R. Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another account. . Code 2: Early Distribution, Exception Applies. Meaning: The distribution was taken before age 59½, but .

Use Code 2 only if the participant has not reached age 59½ and you know the distribution is the following. - A Roth IRA conversion (an IRA converted to a Roth IRA). - A distribution made from a qualified retirement plan or IRA because of . Because you separated from service at 55, you are not penalized for not being 59 1/2. This meets the following 10% penalty exception: Qualified retirement plan distributions you receive after separation from service when the separation from service occurs in or after the year you reach age 55 (age 50 for qualified public safety employees).We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no known exception; 2 – Early distribution (except Roth), exception applies; 3 – Disability; 4 – Death; 5 – Prohibited transaction; 6 – Section .Distributions to terminally ill individuals. The exception to the 10% additional tax for early distributions is expanded to apply to distributions made to terminally ill individuals on or after December 30, 2022. For more information, see Notice 2024-02. Disaster tax relief.

irs distribution code 7 meaning

Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 2: Early distribution, exception applies. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not .

Use Code 2 only if the participant has not reached age 591/2 and you know the distribution is the following. A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331. You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R.You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R.

irs 1099 box 7 codes

commercial grade stainless steel cabinets

What else the extremely compact and inexpensive loudspeaker has to offer and in particular, how it can hold its own against my ultimate budget favourite, the Xiaomi Mi Square .

1099 box 7 distribution code 2 exceptions|1099 form distribution code 7